What does 'APR' mean?

Let's start with the term 'APR' which stands for Annual Percentage Rate. Simply put, if you take out a loan with a company, the APR is a calculation of the annual charges you would need to pay, if you took out a loan for a year or more. These are relatively low for longer-term loans because the interest is much lower in the long-term, but much higher for short-term loans, as these aren't intended to last as long as a year.

Okay, so what does 'Representative APR' mean?

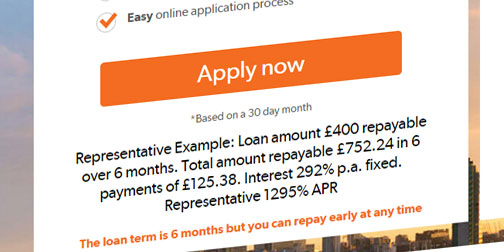

The 'representative' part simply means that the majority of customers who took out a loan with that company, had an APR of that amount. With short-term loans, whilst many customers would not have paid this much back because they didn't have the loan for a year, it is an annual figure. Showing the representative APR is required by law when offering certain financial products, despite most people being unsure as to what it is. Hopefully by the end of this article, you'll understand in more depth about what representative APR means and how it affects you.

The APR is perhaps more valuable for loans or mortgages that will last for a number of years, as this represents what the charges would be each year. As short-term loans are designed for a much short period, the APR looks much higher but actually would look very different if you calculated it for just a half year or for a few months.

In the UK, new rules and regulations for payday loans means that the interest and charges should be no more than 0.8% of the overall loan each day. So if you took out a payday loan of £100 for one month, you would expect to pay 0.8% per day (80p per day). Over the course of the month, the loan should then cost you no more than £24 in fees and charges. The monthly rate here would be 24%, compared to the 1,000% that is shown for annual rates. Of course, if you took out a £100 loan for a year, at 0.8% per day, paying back only the interest until the final month, this would be a total charge of £292, on top of the £100 you had to repay.

The APR is perhaps more valuable for loans or mortgages that will last for a number of years, as this represents what the charges would be each year. As short-term loans are designed for a much short period, the APR looks much higher but actually would look very different if you calculated it for just a half year or for a few months.

In the UK, new rules and regulations for payday loans means that the interest and charges should be no more than 0.8% of the overall loan each day. So if you took out a payday loan of £100 for one month, you would expect to pay 0.8% per day (80p per day). Over the course of the month, the loan should then cost you no more than £24 in fees and charges. The monthly rate here would be 24%, compared to the 1,000% that is shown for annual rates. Of course, if you took out a £100 loan for a year, at 0.8% per day, paying back only the interest until the final month, this would be a total charge of £292, on top of the £100 you had to repay.

Recap of what a Representative APR is

- APR stands for Annual Percentage Rate, and is the amount of interest you would pay if you borrowed a sum of money from a lender for a full year

- 'Representative' simply indicates that the majority of customers had this APR with their loan

- It is require by law when offering certain financial products

- It may be considered more relevant for much longer-term loans, however, it does give customers an indication of how much interest they would pay if they took out a loan for a year.

RSS Feed

RSS Feed