|

So we are officially 100 days into the year already. How have your New Year's resolutions been? Have you managed to save all that money you were hoping to? Did you start the 52 week challenge but not find it a bit of a struggle? Perhaps you need a bit of a pep talk...

What does 'APR' mean?

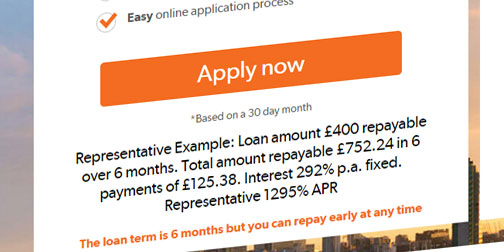

Let's start with the term 'APR' which stands for Annual Percentage Rate. Simply put, if you take out a loan with a company, the APR is a calculation of the annual charges you would need to pay, if you took out a loan for a year or more. These are relatively low for longer-term loans because the interest is much lower in the long-term, but much higher for short-term loans, as these aren't intended to last as long as a year.

Okay, so what does 'Representative APR' mean?

The 'representative' part simply means that the majority of customers who took out a loan with that company, had an APR of that amount. With short-term loans, whilst many customers would not have paid this much back because they didn't have the loan for a year, it is an annual figure. Showing the representative APR is required by law when offering certain financial products, despite most people being unsure as to what it is. Hopefully by the end of this article, you'll understand in more depth about what representative APR means and how it affects you.

The APR is perhaps more valuable for loans or mortgages that will last for a number of years, as this represents what the charges would be each year. As short-term loans are designed for a much short period, the APR looks much higher but actually would look very different if you calculated it for just a half year or for a few months. In the UK, new rules and regulations for payday loans means that the interest and charges should be no more than 0.8% of the overall loan each day. So if you took out a payday loan of £100 for one month, you would expect to pay 0.8% per day (80p per day). Over the course of the month, the loan should then cost you no more than £24 in fees and charges. The monthly rate here would be 24%, compared to the 1,000% that is shown for annual rates. Of course, if you took out a £100 loan for a year, at 0.8% per day, paying back only the interest until the final month, this would be a total charge of £292, on top of the £100 you had to repay. Recap of what a Representative APR is

In August, the BBC launched a new documentary, hosted by Anne Robinson, detailing the secret spending habits of people up and down the UK. Throughout the series Robinson meets Brits in a wide range of situations, looking at billionaire spending right down to where the poor and homeless find their next meal.

It's an insightful documentary, and highlights how people value money so differently, despite it being one common currency. We all have our vices and we perhaps often spend more on certain things than we should, often causing us to rack up debts that can spiral out of control, like Charlotte in episode one, a single mum who aspires to the celebrity lifestyles she reads about on a daily basis, yet her only income are the benefits she receives from the state. The idea behind the documentary comes as more and more people are getting themselves into debt and/or struggling with day-to-day lifestyle costs. Robinson looks at the nitty gritty of where we spend our money and how we value the things we have and don't have. In episode two, Anne meets John Caudwell, one of the richest people in the UK, discovering whether he is one of the happiest men in the UK, seeing as money is supposed to buy you happiness, along with a number of other Brits who waste wildly or are spend savvy. Be sure to check out the next episode on Wednesdays at 9pm on BBC One and see how much you can relate to. Are you at the point where you feel like you are drowning in debt? Maybe you have made some bad decisions along the way. Maybe you have just been very unlucky with your circumstances. Maybe you have had a gambling addiction that you are trying to recover from. Whatever your situation, there is plenty of debt advice on the web to keep you busy for a while.

The first question to ask is, can you afford your current repayments? If you can and it's just the fact that it will take a long time to pay off the debts, then that's great. You have everything under control but it sounds like you are just really keen to get out of debt as quickly as possible. Be patient. It's a long and arduous road but it will come. You could help yourself by looking at earning a second income to help pay off your debt sooner. Whether it's a part-time job in your spare time or a new project or business idea, if you're able to make any additional cash, it will seriously help out your situation. On the other hand, if you are struggling to afford your current repayments and feel like you are drowning in debt, you may be in need of some specialist debt advice. The credit companies do care why you built up so much debt, however, they care far more about the ability to pay it off. If you are in financial difficulty, the best thing to do is speak to your creditors and see if you can come to an arrangement to pay off your debt in smaller payments but over longer periods of time. If, however, you are already working with a debt management company like Churchwood Financial or Clear Start, it's best to also speak to them regarding your repayments. Ask them to run through an income and expenditure report with you to determine how much exactly you can afford to repay your creditors each month. Whatever your situation, do not worry. More often than not, your creditors will be happy to help you if they are worried you won't be able to fulfil your repayment requirements. When you are in debt and you realise that you really need to knuckle down and do something about it, the very first thing you need to do is set up a budget, or as many creditors will refer to it, an income and expenditure form.

Simply explained it is a list of your income and a list of your outgoings to determine how much you are overspending by and how much you can realistically afford to pay debts off with. If you aren't sure where to start, there are many online income and expenditure templates that you can use and if in doubt, speak to your creditors who will be able to provide you with a template or even run through one with you. In your budget, it's important to get every detail down on paper. Every pound counts and you don't want to set yourself a monthly budget, if you have forgotten expenses that mean you will exceed your budget. From haircuts to household cleaning products, take everything into account. Go through the list and work out how much you spend each month including your debt payments. If, by the time you have calculated it all, your outgoings are more than your income, you need to take a look back over the numbers and see if you can realistically cut down. It's no good saying you can cut things out, if in fact, you aren't able to and ultimately fall short at the end of the month and you probably cannot repay debt. If you really can't see where else you can save the extra cash, it's time to look at your debts and how much you have left over at the end of the month to pay your creditors. Work this out and then divide up the remainder between your creditors, depending on the amount you owe each of them. So for example, if you have £100 left over to pay your creditors, but you have a £500 debt with Mr Lender and £1500 with Uncle Buck, you will need to split it into four parts of £25. £25 should be allocated to your Mr Lender loan whilst the remaining £75 should be allocated to Uncle Buck. If you are failing to repay on time, it's important to have all this knowledge in advance of call your creditors to make an offer for a debt management plan. It will make the whole process easier but many creditors will have scare tactics to make you agree to pay back more than you can realistically afford. Please do not worry about this. Only pay back what you can actually afford. Once your creditors have gone through your income and expenditure forms with you, they will also realise that this is all you can afford to pay. You may have to provide evidence of your income and outgoings so be very honest about your current financial position. Once you have agreed a debt repayment plan with your creditor, you can relax, knowing that they won't chase you for payment that you simply cannot afford. Now that the Financial Conduct Authority (FCA) has implemented its rules on pay day loans, which limits certain aspects of the loans to help protect borrowers. These loans can have high interest rates and as such, many people have difficulty repaying them and find themselves getting into more debt by borrowing more or because they miss payments. As a result, it is often better if borrowers are able to find other sources of finance that have smaller interest rates.

Family or friends Whilst you should always avoid loan sharks, borrowing money from a family member or friend is a good option, provided you are able to pay back the money when you suggested, as this could break down a relationship. Friends and family are more willing to lend money at 0% interest, meaning you avoid all fees and the high rates that most financial service companies carry. As mentioned though, be careful to repay the loan as and when you said you would. Bank loans Bank loans, whilst still a loan, offer smaller interest rates than those of payday loans. They also allow you to repay over a longer period of time, meaning repayments can be smaller and more manageable. Speak with your own bank as they may be able to offer you a good rate as a loyal customer. Failing that, try shopping around on websites like money supermarket or money saving expert for a better deal. Credit cards Whilst not a great option, borrowing money on your credit card may offer better rates than a short-term pay day loan. Some credit card companies will not offer this as an option, however, again, it is important to shop around to find the best deals. If you are borrowing in order to pay of a credit card, it could be worthwhile looking a opening a second credit card and transferring the balance. Many credit card companies allow you to transfer balances at 0% interest for up to 18 months so should definitely be another option to look into. From 2nd January 2015, payday loan borrowers will be in a much better position when the Financial Conduct Authority (FCA) enforces new rules and regulations to help protect vulnerable borrowers. The move comes after years of controversial arguments stating that payday loans take advantage of the vulnerable. The new measures will see payday lenders bring in several new measures:

- Short-term loan fees and interest must not exceed 0.8% per day of the total amount that was initially borrowed. This means the cost of borrowing in reduced for most people. - Default fees must not exceed £15. If a payday borrower is finding it difficult to repay and misses a payment, the fixed default fees must be capped at £15 with interest on unpaid balances not exceeding the initial rate (max 0.8% per day). - Borrowers must never pay back more in fees and interest than the amount borrowed. This means that a thirty day loan of £100 will cost no more than £24 in charges and fees. What this also means for borrowers is greater protection against spiraling out of debt due to excessive payday loan charges. What it doesn’t protect against is the ability to take out one payday loan to pay another which should never be done and is the main reason why so many people get themselves caught up in spiraling debt. As part of the proposals in the Summer of 2014, the FCA also estimated that the new rules would mean that roughly 11% of people currently accepted by payday lenders, would no longer have access to payday loans. Many payday loan companies have changed (or are changing) their product offering to accommodate the new rules. This means the introduction of installment loans or potential loopholes in order not to miss out on new business, could mean rather than protecting customers, it makes short-term loan borrowers more vulnerable and could put them in a far worse financial situation than they would have been. It is still up to each individual direct lender as to whether a customer is eligible for a loan under the new FCA rules and will continue to look into the financial details of each applicant, including carrying out credit checks through credit reference agencies. The introduction of the new rules have been celebrated as a step towards protecting those that are financially vulnerable and the FCA is expected to continue to review regulations in order to help protect these people further. If you are hunting for a payday loan to suit your needs, you've come to the right place. On our homepage, we've brought together the leading payday direct lenders in the UK for you to compare and make sure that you go with the right payday lender for you.

It's important to note that a payday loan should only be used in an unexpected emergency and when no other financial option is available. That said, if you are thinking about taking out a payday loan, please make sure that you are able to repay the loan in full and on time. It's important to note that from Our list of payday loans give an overview of those currently on offer in the UK so feel free to look through the list and find a lender that suits your circumstances best. From one repayment payday loans to several installment short-term loans, there is one that is bound to suit your needs. So from Sunny to Wonga and all the smaller lenders in between, take a look but be sure to read the terms and conditions and make sure you are able to repay on time and in full before committing to a short-term loan. |

RSS Feed

RSS Feed